The original post is located at www.elle.com

While designing a luxury wardrobe is a dream shared by many—between the endless temptation of high-end labels in influencer videos and the iconic handbags and shoes flaunted by TV style icons, it can be hard not to fantasize—the current economic climate has been leading us back toward the essentials. With cost of living, the price of groceries, and utility bills all rising, many of us have had to cut back on big and little luxuries like dining out, or even delay larger life plans. According to the Wells Fargo Money Study1, 76 percent of Americans say they’ve cut back on spending, and many have put off things like traveling (74 percent), renovating their home (39 percent), and even buying a home (30 percent) due to current financial pressures.

But there are some simple shopping tips and pieces of advice that can empower you to build a wardrobe that’s thoughtful and lasting, with hopefully less post-purchase guilt. Let’s dive into a few practical strategies to help you create outfits you’ll love while reducing your potential for buyer’s remorse.

Focus on Classics More Than Trends

Start with high-quality, go-to pieces that work across seasons. Think a tailored coat, a perfectly crisp button-down, and classic leather boots—staples that form the backbone of a well-rounded wardrobe and truly stand the test of time. Making smart purchases of items that feel timeless and versatile, rather than quick-fix trends, is a solid strategy. In style terms, that translates to classic pieces—a beautifully structured tote or a wear-with-everything trench—that may deliver more lasting value over fast-fashion alternatives.

Not only will this shopping strategy help you find quality pieces, but it may translate to better spending habits and teach you how to make more thoughtful purchases. Who knew a pair of on-trend sunglasses could also teach us valuable financial decision-making skills?

Keep a Luxe Wish List

We’ve all been there: You’re getting dressed, only to realize the exact piece that would make your outfit sing is missing from your closet—a just-edgy-enough Chelsea boot, a tailored pair of jeans, a sleek belt with jewelry-like hardware for an understated yet eye-catching accent. One way to fill those gaps thoughtfully? Keep a running list in your Notes app for those moments of inspiration. By focusing on pieces that both truly excite you and fill a practical gap in your wardrobe, you’re less likely to splurge on impulse buys that may neither last nor serve you as well.

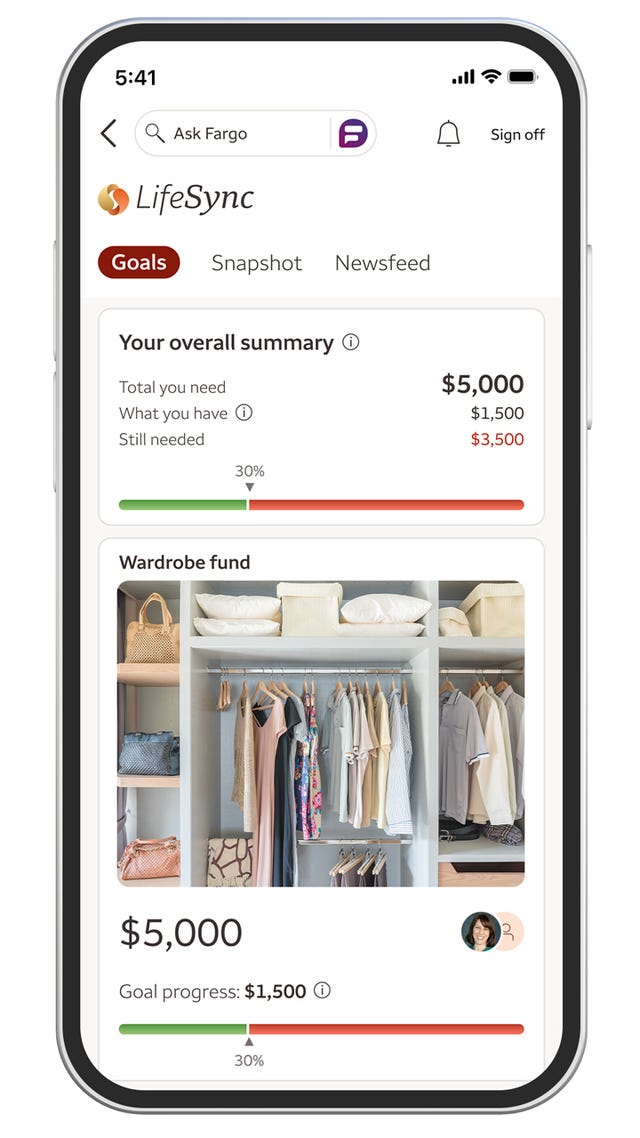

With Wells Fargo’s LifeSync®2 in the Wells Fargo Mobile® app, you can take that wish list a step further by setting specific savings targets for each piece and actively saving to purchase them, so your wish list can become more attainable. In the Wells Fargo Money Study, almost two thirds of Americans surveyed (67 percent) said that even though they’re able to pay their bills, they have little left over for extras—a “scarcity mindset” that can make that designer coat you’ve been eyeing a constant reminder of what you can’t afford. LifeSync lets you name your goal, set a target amount, add a custom goal image, and track your progress in real time to keep you motivated and show you how close you are.

A Savvy Savings Strategy

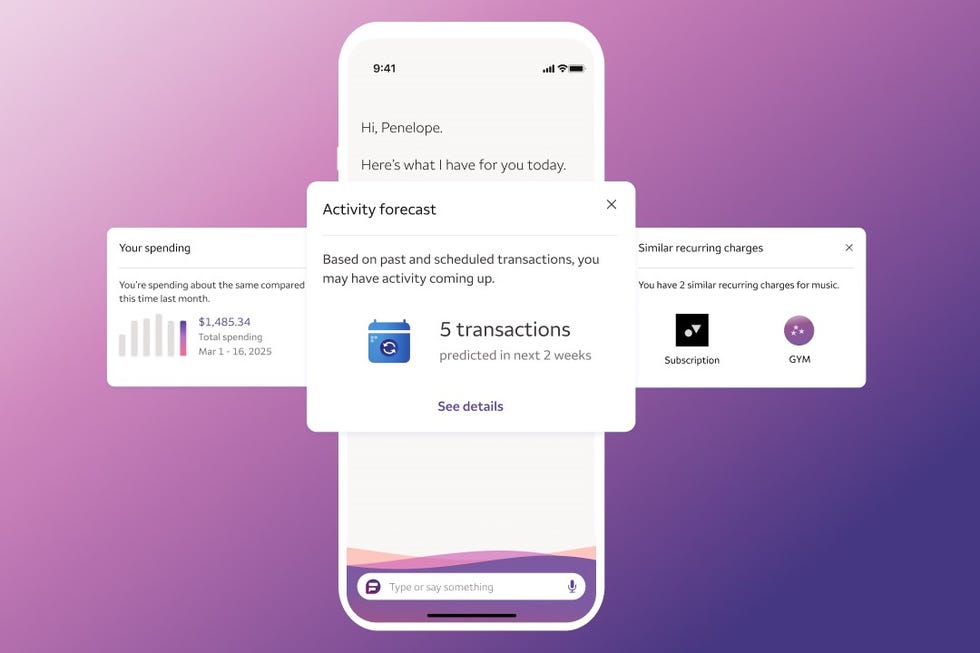

Another smart move that can help you save for luxury pieces without sacrificing the essentials: Wells Fargo’s virtual assistant, Fargo®3, in the Wells Fargo Mobile® app provides personalized insights that can flag places you may be able to trim costs (like that subscription you completely forgot about). With these insights, you can understand where you can better manage trade-offs in your spending to save for your wardrobe fund. You can even ask Fargo to “manage spending,” and it will take you to a view of your spending that can then direct you to LifeSync to kick off that personalized goal (which you can label “My Wardrobe Fund” for easy reference).

Fargo can help you monitor your spending each month (which you can also see in your “manage spending” goal in LifeSync) as well. It analyzes your cash flow and spending habits and can calculate your upcoming activity and balance forecasts—so you can confidently understand when to indulge in a designer piece without disrupting your budget.

The One-In, One-Out Rule

Imagine finally splurging on that impeccable cashmere knit you’ve been dreaming about, or the ultimate work-to-cocktails dress that will carry you through any occasion…only to realize there’s no space for it in your overpacked closet. That’s where the “one-in, one-out” rule comes in: For every new piece you add, part with something that no longer serves you, or sell a well-worn favorite for a luxurious upgrade you’ll reach for time and again. This approach helps keep spending in check and your wardrobe fresh and intentional, filled only with pieces you’re genuinely excited to wear.

When you apply these strategies, your purchases will feel thoughtful and intentional—ensuring you end up with a wardrobe that reflects both your style and your savvy. All while helping you stay within your budget and on track for larger life milestones.